Credit Card: This is a typical credit card, charge card, etc. Bank: This is a typical bank account, such as a checking or savings account. Account Type This is the kind of account you are adding. Account Number This is the account's number (such as a bank account number) and is used solely as a reference for your convenience. You can enter any name you want, for example: "Checking," "Visa," "George's Bank Account," and so on. Below is an explanation of the fields you have to fill in: Account Name This is the name of the account. To add a new account, click on the Tools->Accounts menu option and then click the Add button. of 58ġ4 Adding Accounts To keep track of an account's activity, such as your checking account, you must first add the account to Moneyspire. In addition, accounts in foreign currencies will be automatically converted to your local currency (at the current exchange rate) when generating reports, displaying balances, etc. You can manage your currency rates by clicking the Tools->Currencies menu option in the program. By default, the current rate specified in the currency manager will be used, however you can change that. After that, whenever you do transfers between accounts which have different currencies, you will be asked to specify a rate between the two accounts. When configuring an account for the first time, you are asked to select the account's currency. So you may have one bank account in US Dollars, and another bank account in Canadian Dollars for example. Multiple Currency Support Moneyspire allows you to have accounts in multiple currencies. Moneyspire will automatically open the last file you worked on when you start the program up. To open a file, click on the File->Open menu option. To create a new file, click on the File->New menu option. Each data file will have its own set of accounts, reminders, categories and budgets. For example, you may want to keep one data file for your personal finances, and another data file for your child's personal finances. Keeping Different Sets of Files Moneyspire allows you to keep different sets of data files. Once an investment account is added (via the Tools->Accounts menu option), you can manage your investments (securities) via the Portfolio button in that account register for that account, and record your investment transaction activity. of 58ġ3 Managing Investments Moneyspire allows you to easily manage your investments. You should clear a transaction when you know it has been processed, for example, when a check has been cashed. You can clear a transaction by checking its corresponding check box, or by using the reconcile feature. You will also notice there are two balance columns, one labeled 'Balance' and the other labeled 'Cleared Bal ' The first column displays the total balance of all the transactions, while the second column displays the total balance of all the cleared transactions.

You can customize the transaction register options by clicking the View menu option. You will then be taken to the account's transaction list where you can add, edit or delete transactions. Accounts and Transactions To view an account's transactions, first click on Accounts on the top, then double-click the desired account. You can also save reports so that you can quickly view them at any time without having to configure the report options again.

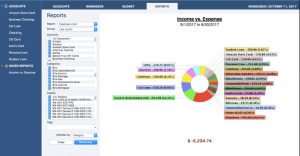

Reports The reports screen allows you to generate detailed reports on your expenses, income and net worth. You can also click on an individual budget category to see a detailed list of the spending for that particular category and budget period. Budget The budget screen will show you how you are currently doing on your budget, including how much money you have spent and how much money you have left in your budget (or how much money you have overspent).

0 kommentar(er)

0 kommentar(er)